The End of Jobs By Taylor Pearson - Summary and Book Notes

Taylor Pearson wants you to be an entrepreneur. Maybe you’re scared of entrepreneurship: “it’s too risky”, “I need a steady paycheck to be safe”. If Pearson is right, the riskier option is to stay at your job.

Review

This is an excellent book. Pearson lays out his arguments in a thoughtful and convincing manner. His research and experience with entrepreneurship shows. The later sections on how to become more entreprenurial could have been more fleshed-out, but that’s really a topic for another book. Maybe for an established entrepreneur, the ideas presented are obvious. For the rest of us, the book’s main thesis is enough to make this a must-read.

I highly recommend this book for:

- The office worker discontent with his job, but still unsure of how to make the jump.

- The recent college graduate, worried about her future prospects in the job market.

Buy “The End of Jobs” on Amazon or check it out at the library.

Quick Summary

- Regular jobs are going decreasing in value every day. Why? Globalization, technology, and the increase in supply of college graduates.

- The economy is shifting from knowledge work to entrepreneurship. Being able to operate in complex, chaotic domains is the new scarce resource.

- A steady job hides silent risks, which accumulate until they grow large enough to be catastrophic. It’s safer to be exposed to small risks often, it’s safer to be an entrepreneur.

- Technology is revealing the long tail of markets and making entrepreneurship more accessible than ever.

- Entrepreneurship is more profitable than a job can ever be. Jobs are time constrained and have limited upside.

Notes

The following are rough notes I took while reading. These are mostly paraphrased or quoted directly from the book. My thoughts are in italics.

Section 1: Have We Reached the End of Jobs?

Entrepreneurship: connecting, creating, and inventing systems—be they businesses, people, ideas, or processes.

Job: the act of following the operating system someone else created.

End of Jobs: Sharp rises in communication technology and improved global educational standards over the past decade means that companies can hire anyone, anywhere. The notion of machines, both hardware and software, taking over blue collar factory jobs is now largely accepted—but now they’re increasingly taking over white collar, knowledge-based jobs as well. Traditional university degrees—bachelor’s, master’s, and PhDs— have become abundant, making them less valuable than ever.

Globalization

It’s much easier to globalize a technology, spreading it to another area, than it is to innovate and create one from scratch.

If your job is unfairly and unjustly moved overseas, it’s still gone. It’s more effective to accept this reality and work to improve it than to bemoan it from the sidelines.

The best way to improve conditions is for individuals with a strong moral compass to acquire power and build better systems.

The Acceleration of Technology

Humans evolved to live in a linear, biological world, a world dramatically different from the one we live in now.

Both the growth in technology and globalization are continuing at an accelerating rate.

The Commoditization of Credentialism

Even for individuals with an advanced degree who are able to get a job, the value of a degree is dropping.

It’s now less valuable than ever to understand how to follow directions and implement best practices. It’s the work of understanding and operating in the complex and chaotic systems—entrepreneurship—that’s increasingly in demand.

Section 2: Why Are We at the End of Jobs?

“Theory of Constraints.” Goldratt’s theory explains that any system with a goal has one limit, and worrying about anything other than that limit is a waste of resources.

Previous Economic periods: Agricultural (1300– 1700), Industrial (1700–1900), and Knowledge (1900– 2000).

The limits that shifted the Economic periods: Land, Captial, Knowledge Workers

We aren’t going through a global recession— we’re transitioning between two distinct economic periods.

The limit is shifting from knowledge to entrepreneurship.

The entrepreneurial Complex and Chaotic domains are the ones increasingly in demand. The dominant institution is shifting from Corporation to the Individual (or self). What used to require large companies, technology, and globalization has now been made available to the individual or micro-multinational. The dominant player is shifting from CEO to Entrepreneur.

New Economic Period: The Entrepreneurial Economy (2000ish–???)

We’re at a transition point from knowledge to entrepreneurial work. The individuals who will gain the most from the transition are those that invest early and heavily in Entrepreneurship

How do you invest in Entrepreneurship?

Entrepreneurship is a skillset which can be acquired.

Right now, there’s no way to measure entrepreneurship.

Instead, we invest in them with life decisions. Choosing to get an apprenticeship working in an entrepreneurial company instead of going to work in a major corporation is a major career investment decision. Choosing to take ownership of a complex project instead of saying “that’s not my job” is an investment decision.

Many entrepreneurs that used to have good jobs end up financially more successful than previous peers. They aren’t pushing any harder. They’re using a longer lever.

Section 3: Entrepreneurship Is Safer Than Ever

We frequently avoid making choices not because the outcome is bad, but simply because it’s unknown.

loss aversion: when directly compared to each other, losses loom larger than gains.

Thriving in Extremistan

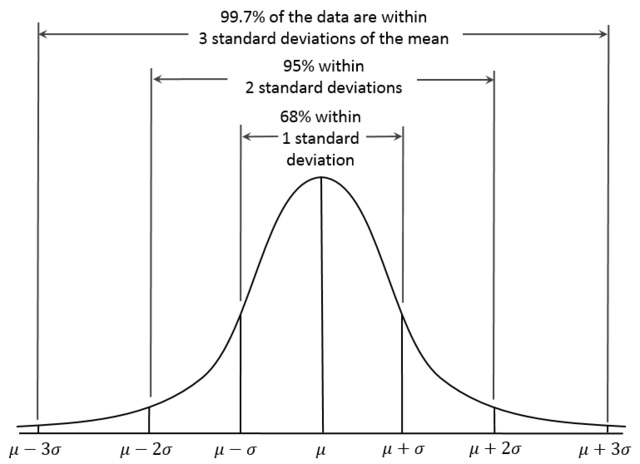

You were raised in mediocristan. Biological systems, ‘fair’ systems like grades, all follow a nice Gaussian curve.

This Gaussian bell curve distribution makes sense intuitively to us. It’s fair (a dangerous concept).

Non-biological systems, man-made systems, modern systems like the economy, our businesses and our careers, don’t live in Mediocristan. They live in Extremistan.

Extremistan is marked by a Pareto distribution. The height of everyone in a bar follows a bell curve. If Bill Gates walks into the bar, the curve doesn’t change much. But if you look at the net worth of everyone in the bar, Bill’s presence skews the graph.

Bill is on the left, his net worth off the charts. I’m somewhere on the right :(

As technology continues to evolve, we are increasingly living our lives in Extremistan.

How to be a Turkey

“A turkey is fed for a thousand days by a butcher; every day confirms to its staff of analysts that butchers love turkeys ‘with increased statistical confidence.’ The butcher will keep feeding the turkey until a few days before Thanksgiving…[ The] turkey will have a revision of belief– right when its confidence in the statement that the butcher loves turkeys is maximal and ‘it is very quiet’ and soothingly predictable in the life of the turkey.” – N.N. TALEB [2]

Steady income creates a Mediocristan: the illusion of steady value creation. This is dangerous. Fatally dangerous. It’s allowing us to accumulate silent risk.

The longer the market goes without having a correction, the larger the correction will be when it happens. The longer we go in our careers and businesses without variation or randomness, the larger the amount of underlying risk we accumulate.

Moderate amounts of volatility are healthy.

Large amounts of volatility, like having a car dropped on you, will kill you.

If you put yourself in a position which creates very little value in the market for ten years, and it gets replaced by machines or Marissa from the Phillippines when you’re 40 years old, at peak earning potential, with a family and mortgage, you’re a turkey on Thanksgiving.

For Rand (a hypothetical entrepreneur), not making money is feedback. There’s no silent risk accumulating. If Rand puts up a website and no one buys his product, that’s feedback. He can adjust and has adjusted. Money wasn’t hitting his bank account, so he’s changed the product; he’s changed the marketing; sales are starting to improve.

But now he’s learning where to forage, how to forage, and the days he goes hungry are the days he’s learning the most.

Entrepreneurial risk is more visible than the silent risk accumulated by people in most jobs.

Rand also develops another skillset in the complex domain: dealing with risk.

The rules and the leverage points have changed in ways that were never made clear to us growing up. Many people are entering Thanksgiving week.

What was once safe is now risky. What was once risky is now safe.

Section 4: The Long Tail Or What’s Making Entrepreneurship More Accessible

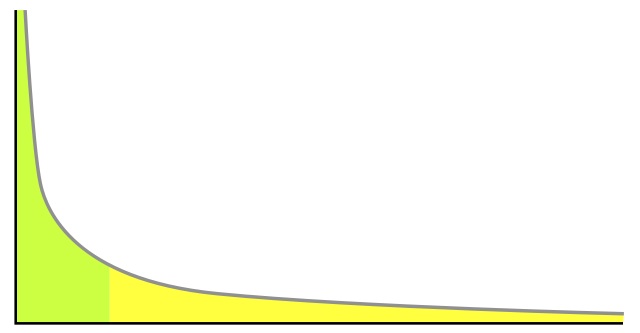

CD Baby revolutionized the music industry by escaping the limitations of the short head and “revealing” the Long Tail.

Let’s look at this power curve again. Previously record companies could only sign artists who would sell enough copies to cover distribution costs to record stores (the green section on the left, the ‘short head’). CD Baby enabled smaller artists to sell CDs directly to fans, opening up the yellow section on the right [4].

The Democratization of the Tools of Production

The tools of production are getting cheaper:

- Rent to own: the sharing economy

- Software as a service: plug and play tools and systems

- Marketplaces and contractors: plug and play team members and project partners

- Self-education: information wants to be free

- It’s cheaper to make widgets

The Long Tail has let businesses emerge that are hyper specific and couldn’t have existed in a retail world

The Democratization of Distribution

the gatekeepers are dying (music labels, publishers, etc)

We’ve gone from three channels on TV to three billion on the internet

You are a media company. What traditionally cost hundreds of thousands in advertising is now available to you.

New Markets Are Created Every Day

Movie theaters, record stores, and retail businesses can’t serve latent demand. The latent demand has always existed, but the economics of retail didn’t allow it.

Internet makes geography irrelevant => Millions of new market verticals

These are all opportunities where jobs are going to be replaced by software, and you don’t want to be the one with the job— you want to be the one who owns the software.

The democratization of the tools of production means it’s easier to make something. The creation of new markets means there are more and more people to sell those things to, and the democratization of distribution means they are getting easier and easier to reach. Just as jobs are more competitive and threatened than ever, entrepreneurship has become more accessible.

How to Become More Entreprenurial

The entrepreneurial skillset falls in the complex square of the Cynefin framework, an emergent practice [1]. You need other skills which still don’t have well-defined methods of learning them other than the hard way— actually doing them.

You also need a different type of relationship: relationships with other entrepreneurs. you need an entrepreneurial network and an entrepreneurial track record.

Many full-blown entrepreneurs today started freelancing on the side, then transitioned to consulting or freelancing full time, and some have chosen to release their own products.

The Stair Step Method [9]

The first step in the Stair Step Method is launching a product that sells for a one-time fee and has a single marketing channel.

Step two is launching enough of those one-time products that you’re able to buy your time back.

Step three. Instead of working nights and weekends like you had been, you’ve got 40– 60 hours a week to put in on your business, giving you a platform to launch bigger products, and projects from.

Start with a relatively ambitious but discrete opportunity, and use that to build out your skillset and relationships for the next project.

The latent demand and lower barriers to entry have allowed more people to become entrepreneurs by easing their way into the process. That’s not to say it’s easy— you still have to climb the stairs, but no longer in a single bound.

The Return of Apprenticeships

Apprenticing today works on the same premise as stair stepping— it’s a way to build skillsets and relationships.

Find someone that is doing what you would like to be doing in five to ten years and cut them a deal: “I’ll come work for you for relatively cheap and I’ll create results you would normally have to pay a lot more for, in exchange I get to train at altitude. I get to see the inside of how your business works: how you launch products, what the industry looks like, and who I need to know.”

Advantages of Apprenticeships to the Apprentice

- Relationships. You don’t need a business idea–you need relationships

- Become more effective in complex environments

- Play with house money

Apprenticeships are also an astoundingly good value right now.

Advantages of Apprenticeships to Entrepreneurial Companies

- Less risk for employers.

- You attract higher quality applicants.

- You build an alumni network of smart, ambitious people.

Note: If you’re interested in an apprenticeship, grade yourself on these five criteria. Do you have a history of work you’ve accomplished to show? Are you on a trajectory that would make you attractive to hire as an apprentice?

Section 5: Entrepreneurship Is More Profitable Than Ever

“I don’t think of work as work or play as play. It’s all just living.” - Richard Branson

Shifting to agriculture wasn’t a decision that Neolithic cultures consciously made because they were happier or more fulfilled. It was one that led to economic prosperity and power. The societies that encouraged that behavior won out by force.

The traditional job-based, simple and complicated work of “do X get Y” model has ceased being effective.

As humans, we love to work but dislike the obligation of it—the job-based paradigm.

Complex, entrepreneurial work is both more valuable and more in line with traditional human drives. Suppressing fundamental human motivators was a 3000-year-old anomaly that’s now coming to a close.

Three core motivators: money, freedom, and meaning.

After a certain point (~$75,000 annual salary) money becomes dramatically less motivating.

we can structure meaning and freedom into our work now— work goes from being an obligation to a choice. By harnessing freedom and meaning earlier in our careers and putting it into our work, we can now live freer, more meaningful lives that help others, and get rich doing it

The Economics of Entrepreneurship

Any society where money (as a proxy for wealth) is a limited resource would do well to prevent people from loaning it to one another. If wealth is limited, which it was for most of human history until around 1800, then a loan can only result in one party losing and the other winning.

Our understanding of money and wealth creation as a society is rooted in pre-industrial notions.

Profit, then, is simply the difference between the consumption and production of a living thing—

If the farmer and food manufacturer don’t produce a profit, there’s no food to distribute as food stamps. The attempt to distribute first and profit second was attempted by Stalin, and led to the starvation of seven million people in Ukraine.

Jobs (The Slow Lane) vs. Entrepreneurship (The Fast Lane)

The slow lane: jobs, a path that most people raised in our society see.

The fast lane: entrepreneurship, the path most people don’t see and one that’s becoming easier, safer, and more profitable [6].

Jobs suck because they’re rooted in limited leverage and limited control. Sure, you can have great job (and a fun one too!) but in the scope of wealth, they limit both leverage and control— two things desperately needed if you want wealth.

Jobs are fundamentally linked to time. Can make more money and more wealth. Can’t make more time.

You give up control. If external market forces doom the company, they doom you as well.

Jobs don’t do a very good job of protecting downside. Jobs were safe in a world where more and more were being created and wages were increasing— which they were for most of the 20th century. Since around 1980, that hasn’t been the case.

The alternative to jobs, entrepreneurship, is based on Fast Lane math. At its core is a focus on rapidly building assets that grow without perpetually requiring direct intervention.

only 10% of penta-millionaires (net worth $ 5 million) report that their wealth came from passive investments.

While a high-paying job in finance may get you money and a beach bum lifestyle may get you time, it was only entrepreneurs that had both money and time.

Fast Lane is: Wealth = Net Profit + Asset Value Net Profit = (Units Sold) × (Unit Profit) Asset Value = (Net Profit) × (Industry Multiplier)

In a job, your upside is always limited.

Most self-funded startups, entrepreneurs, and businesses I work with and talk with are disappointed by 20% annual growth in the business, while most people with jobs I know are grateful to get their 3% annual cost of living raise. Because they have unlimited control and unlimited variables, exponential growth is possible.

Assets Are More Valuable Than Cash

Unlike a job where your income is simply cash, net profit is actually the number used to value your business as an asset.

$50,000 raise vs $50,000 extra profit: In a business you own, you generate an extra $ 50,000 in profit. You add not only $ 50,000 to your pocket, but also $ 100,000 in asset value to your net worth because of the multiple. Unlike a raise, adding $ 50,000 in profit to your company’s bottom line increases the value of the asset, which you own.

It’s cheaper, easier, and safer to start a business. When you grow it using variables you control, you make more money because you have unlimited leverage. You also are building an asset which can be sold. And, you’ve acquired a skillset that protects your downside.

Compound Interest Is Valuable–Once You Have a Lot of Money

many non-entrepreneurs see entrepreneurial success as luck. They think people that have prosperous businesses just got lucky and were “overnight successes.” They don’t see the years or decades of work, skill acquisition, and relationships that the entrepreneurs built up.

Expected Value: It’s normal for poker players to lose a hand worth thousands of dollars, but be happy with how they played it. They understood what the probabilities were and bet accordingly.

The typical way someone approaches this might be: “If I get a job, I can make $ 50,000/ year. If I start a store I could potentially make more, but it’s also risky.” They never specifically quantify the outcomes, leading to poor decisions.

While no individual opportunity is guaranteed to pan out, systematically pursuing opportunities with a positive expected value means you’re going to find success over time.

Dan Norris failed at 83% of the businesses that he launched in 2014, but the success of WP Curve more than made up for all those failures.

More Freedom

the level of freedom enjoyed by the average middle class individual in the West today is beyond the wildest imagination of anyone alive in the 19th, much less 18th, century.

But the most powerful are those who design both their own realities and the realities of others. The entrepreneur defines reality, he is not defined by it. He is engaged in a dialogue with his reality asking “why” and “why not” instead of “how” or “what.”

If we think of the great contributions made to human society, they were all made by people that were free to do whatever they wanted, but used the freedom to create.

Great work— the kind of work that will create wealth in our lives and the lives of others is not the product of obligation— is the product of freedom. Freedom gives us a longer lever, a better leverage point.

More Meaning

Happiness is a condition which can be prepared for and cultivated.

We cultivate happiness through seeking what Csikszentmihalyi calls flow. Flow, at its essence, is the ultimate natural expression of the human desire to grow and stretch [7].

when we treat work as jobs, as an obligation, a disutility, something that has to be balanced, the inherent tendency to grow breaks down.

If someone is worried about making ends meet or paying rent, they won’t have a lot of creativity to spread around.

We are naturally predisposed to be growing, goal-seeking, striving creatures. By following that impulse we can create more valuable work. A natural drive towards an intellectual challenge resulted in more innovation

For heuristic, complex tasks, paying more money decreases performance

In another experiment where researchers looked at artists, they found that the work was actually worse when they were doing it as a job as opposed to something they chose to do.

The biggest problem we’re dealing with today is the underutilization of individuals. The most talented and ambitious young people, when they feel under-utilized in the jobs, shrink to fit their position. Complex entrepreneurial work is what is in short supply, and jobs where we are working as an obligation hurt our ability to do that.

We’re goal-seeking, striving creatures. We seek goals which create meaning and freedom in our lives. The lack of meaning is a modern problem. It’s solved by pursuing a goal greater than ourselves. In doing so, we actually produce more valuable work, are happier, and as a side effect, make more money.

For most of our generation, there isn’t a clearly-defined opportunity or generational promise.

you look at someone five years ahead of you professionally, like looking down the hallway at an office, is that someone whose life you want? are you excited about that future?

Conclusion: The Future of Work

the means of production, available exclusively to the wealthy for all of human history, are now in your hands.

While we all sense on some level the expanding amount of possibility and opportunity available to us, you must step up to seize it. We’ve reached the end of jobs. The implicit promise of jobs made to our parents of long-term, stable employment is dying

We tend to overestimate our ability to get things done in the short term, but underestimate our ability to get things done in the long term.

What if you spent an hour every day working on that project you’ve been thinking about? Writing a book; launching a product on the side to begin stair stepping; looking for an apprenticeship with a company you admire; building a business that you could tell your grandchildren about. we underestimate what we can accomplish in three years, how much are we underestimating ourselves over the next thirty years?

Next Steps

‘Barbell Strategy’

The first rule of career planning: Do not plan your career.[8]

You can’t plan your career because you have no idea what’s going to happen in the future.

Instead of planning your career, focus on developing skills and pursuing opportunities.

If my notes piqued your interest, give the whole book a read. Let me know what you thought of the book.

Similar Articles:

References Mentioned

[1]: Cynefin Framework

[2]: Antifragile by Taleb

[3]: The Hard Thing About Hard Things by Horowitz

[4]: The Long Tail, Anderson

[5]: The 7 Day Startup by Dan Norris

[6]: Millionaire Fastlane by DeMarco

[7]: Flow by Csikszentmihalyi

[8]: Marc Andreessen’s Guide to Career Planning

[9]: The Stairstep Approach to Bootstrapping